Public Companies

Microsoft, Google, Disney, Home Depot, Apple, BP, Nestle, Toyota, Samsung. These companies are all household names. You or an acquaintance have almost certainly bought something from one of these companies.

What do these companies in the graphic have in common? They produce goods and services billions of people all over the world use; food, medicine, gas, phones, entertainment, and so on. They make billions of dollars in revenue.

Moreover, they are all publicly traded. That is, every single one of these companies is listed on a stock exchange; members of the public can own shares of each of these companies’ stock.

In fact, right now, you most likely can:

create a brokerage account with an online stock broker,

and buy shares in these companies.

US and International Companies

Most of these companies are U.S. companies (top-half) while the rest are International companies. Each of these companies have a ticker identifying them on their stock exchange. e.g. Disney (DIS), Costco (COST), Ford (F), Toyota (TM) and AstraZeneca (AZN).

These companies have a fiduciary duty to their shareholders (investors). The companies leadership and board of directors work to ensure their owners have a return on their investment in the company. Many publicly traded companies reward shareholders by paying dividends or buying back1 their own stock.

Most customers of these companies have an opportunity to align themselves with these companies’ profit-motive by being shareholders.

Nevertheless, no investment guarantees a future return or profits. Investments carry risk and can lead to losses.2

Index Funds - baskets of stocks

You might ask, how do I know what stock to invest in? Which do I pick? Well, I am not a financial adviser, but a popular vehicle for investing in the stock market is the index fund. You can think of an index fund as a basket of stocks; it lets investors own shares in hundreds, if not thousands, of companies and securities through one vehicle. Remember the wise adage? “Don’t put all your eggs in one basket”.

The proportion each company takes in an index depends on how the index weights each company. One of the most common types of index funds is a market-weighted index fund. This is a fund where each company’s portion is weighted by its market capitalization (i.e. the total value of its outstanding shares) relative to others.

Some index funds can be bought directly from a mutual fund company, while others are listed on a stock exchange, just like public companies. These index funds can be bought and sold directly through a stock broker. These funds are called ETFs (Exchange Traded Funds). The companies in the article’s graphic exist in one of two ETFs - VTI and VXUS.

Example ETFs - VTI and VXUS

VTI is the Vanguard Total Stock Market Index Fund ETF. It seeks to track the performance of the total US stock market. The overall fund contains shares in almost 4,000 companies weighted based on their market capitalization (total value of shares outstanding in the open market). The more valuable a company is the larger its share in a market-weighted index fund.

VTI has far more than 40 companies, but the tree-map shows only the top 40 to give a sense of the type and size of its constituent companies. Apple Inc. (AAPL) (as of Jan 30 2023) was about 5.33% of VTI, or about ~5% of the overall stock market’s value. The next largest company is Microsoft (MSFT) with a percentage of ~4.5%. Home Depot (HD) is about 0.81% of VTI.

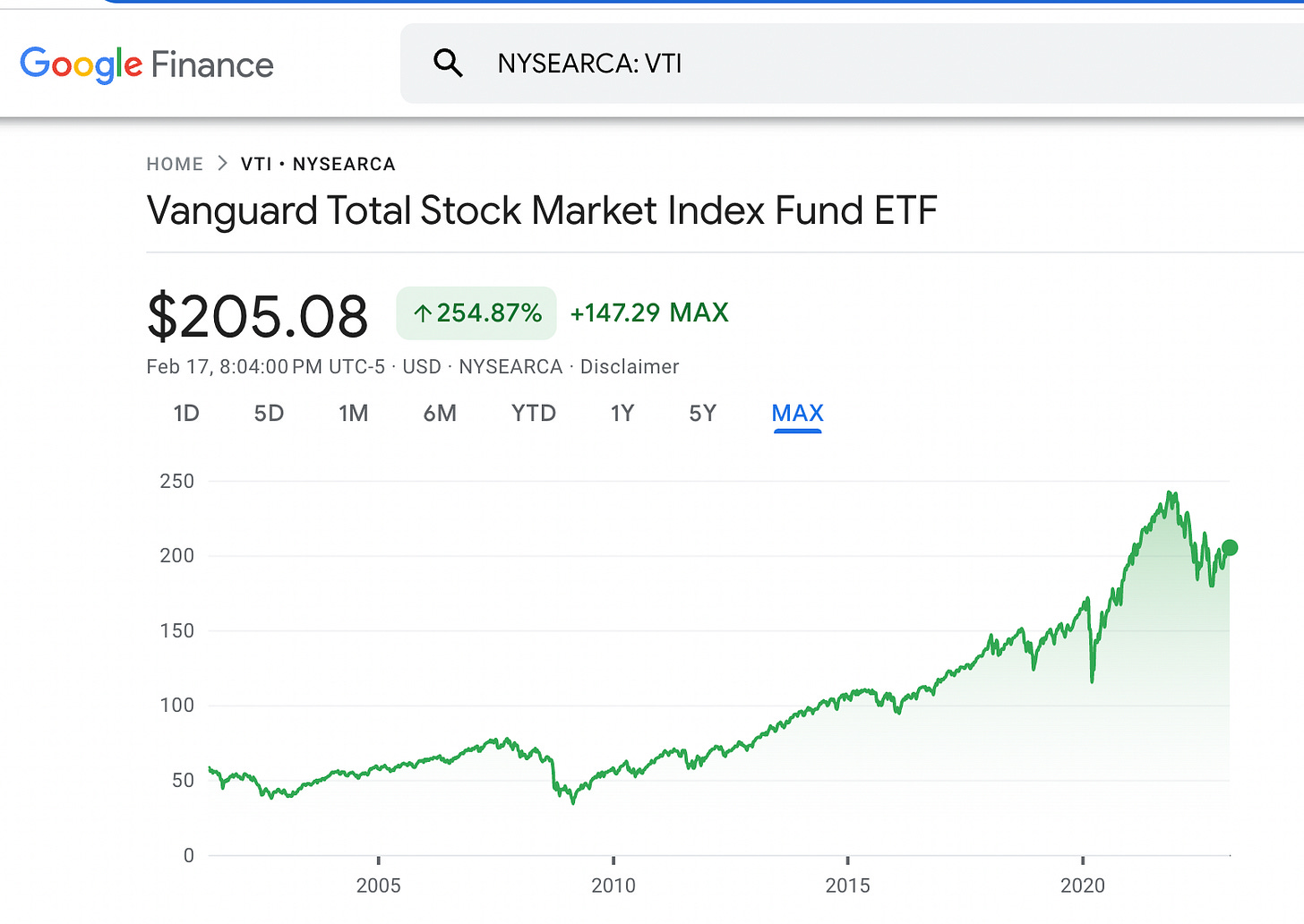

Above is a graph of the price of VTI over time. We can’t predict future prices (they could go up or go down). Still, if one had invested $4,300 20 years ago (2003), it would be worth about $20,500 now, not including fees or dividends. For context, the current yield of a share of VTI is about 1.53% ($153 for every $10,000) while the expense ratio is 0.03%.($3 for every $10,000 invested). This illustrates how powerful compounded growth can be (but that’s a topic for another day).

If one wants to buy a fund of non-US/International companies (a.k.a. ex-US), one can consider VXUS3 (the Vanguard Total International Stock ETF). One can hold some percentage of their portfolio in VTI and another in VXUS to ensure international diversification. Alternatively, one can buy VT to hold both US and International stocks with a single stock.

When choosing an ETF/index-fund, consider passively-managed, broad-based, low-cost index funds :

broad-based → diversified, typically market-weighted. See EMH efficient market hypothesis.

low-cost → fund costs and fees are as low as possible.

Vanguard4 index funds, for example, have an average expense ratio of 0.09% compared to the industry average of around 0.49%. VTI has an expense ratio of about 0.03%.

passively managed → the fund tries to track an index. It doesn’t rely on stock picking.

This is compared to active management where a fund manager actively tries to make trades to beat the market or an index.

“When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients. Both large and small investors should stick with low-cost index funds.”

- Warren Buffet. see CNBC article

“Vanguard manages to keep its low-cost edge across the fund spectrum based on a unique ownership structure despite competition from the likes of other fund companies like Schwab and Fidelity that promise low fees on certain funds.“

- Investopedia article. The 10 Cheapest Vanguard ETFs

There are many other index funds and ETFs investors can consider, such as Schwab U.S. Broad Market ETF SCHB, Fidelity Total Market Index FSKAX or iShares Core S&P Total U.S. Stock Market ETF ITOT

Conclusion

In conclusion, don’t just be a consumer, but consider being an owner of companies via index funds. Build a habit of investing regularly even if it’s 20, 50 or 100 dollars a month. Your future self will hopefully thank you! If you want resources to dive into, see the links below.

Links

Book - The Bogleheads' Guide to Investing - Highly recommend this book!

VTI top 40 and VXUS top 40 treemaps

Videos

Two Cents

Plain Bagel

Ben Felix / Common Sense Investing

Vanguard Links

Stock buybacks reduce the supply of a stock on the market, which increases the price of shares outstanding in the market owned by shareholders.

While past performance does not guarantee future returns, investing in the U.S. stock market in the long term has provided extraordinary returns on the order of 7 - 10% yearly (which is hard to beat).

VXUS’ price hasn’t performed as well as VTI in the last 20 years. You can see performance here. It does have a higher dividend yield and its better to evaluate overall market performance in the long term. Finally, past performance doesn’t guarantee future results. No one can predict the future whether it’s VTI, VXUS or any investment. However, the total stock market is one of the best ways one can invest their money given empirical proof that it’s hard for most investors to consistently beat the overall stock market.

Great write up Tosin!